Back

Brokerage Business

How To Start A Brokerage Firm? — Comprehensive Guide

Written by:

Vitaly Makarenko

read

Published:

January 17, 2024Updated:

May 3, 2024views

Table of contents

In today’s globalized world, financial markets have never been more accessible or enticing. With emerging asset classes like cryptocurrencies and the evergreen appeal of the Forex market, the lure to facilitate trading and earn from the buzz is palpable. Brokerage firms, both traditional and those specializing in newer asset classes, have an instrumental role to play in this dynamic landscape, and starting a brokerage can be a promising venture. This guide dives deep into the intricacies of understanding the various types of brokerages, as well as what it takes to establish your own brokerage firm.

Understanding Different Types of Brokerage Firms

In the ever-evolving financial landscape, several brokerage archetypes have emerged, each catering to distinct investor needs and preferences. Let’s explore these types in detail.

Full-service Brokerages

Full-service brokerages are often viewed as the behemoths of the brokerage ecosystem. They provide an all-encompassing suite of financial services, from tailored advice to portfolio management. These firms operate with an expansive reach, often on a global scale, and their clientele typically consists of high-net-worth individuals and institutions. What sets them apart is their commitment to personalized service. Each client’s portfolio benefits from dedicated financial experts who actively manage and reallocate assets. This is complemented by the firm’s exhaustive research and analytics division, producing in-depth market reports and insights.

Discount Brokerages

On the other side of the spectrum lie discount brokerages, primarily oriented towards the modern, tech-savvy investor. These platforms prioritize efficiency and cost-effectiveness. While they provide the essential tools for self-directed trading, they do away with the added layers of advisory services typical of their full-service counterparts. Their digital-first approach shines through in their user-friendly interfaces, integrating advanced charting tools, and, in some instances, robo-advisors to guide investment decisions.

Forex Brokerages

Navigating towards the specialized realm, Forex brokerages emerge as gatekeepers to the largest financial market globally – the Forex market. Operating 24/7, this market is a magnet for investors keen on profiting from currency fluctuations. These brokerages offer substantial leverage, empowering traders to manage significantly larger positions than their initial capital would otherwise allow. The trading here is distinctive, focusing on currency pairs, such as the EUR/USD or GBP/JPY. Recognizing the intricacies of this market, many Forex brokerages also equip traders with educational resources, aiding in honing their skills.

Crypto Brokerages

In the dawn of the digital age, crypto brokerages have carved their niche, serving as the nexus between traditional finance and the avant-garde world of cryptocurrencies. The rise of Bitcoin ushered in a new era, and these brokerages have been pivotal in providing access to this burgeoning asset class. They offer an extensive array of digital assets, extending beyond the renowned Bitcoin and Ethereum to a myriad of altcoins. Security is paramount, prompting many to adopt measures such as cold storage, ensuring a significant portion of their digital assets remain insulated from online vulnerabilities.

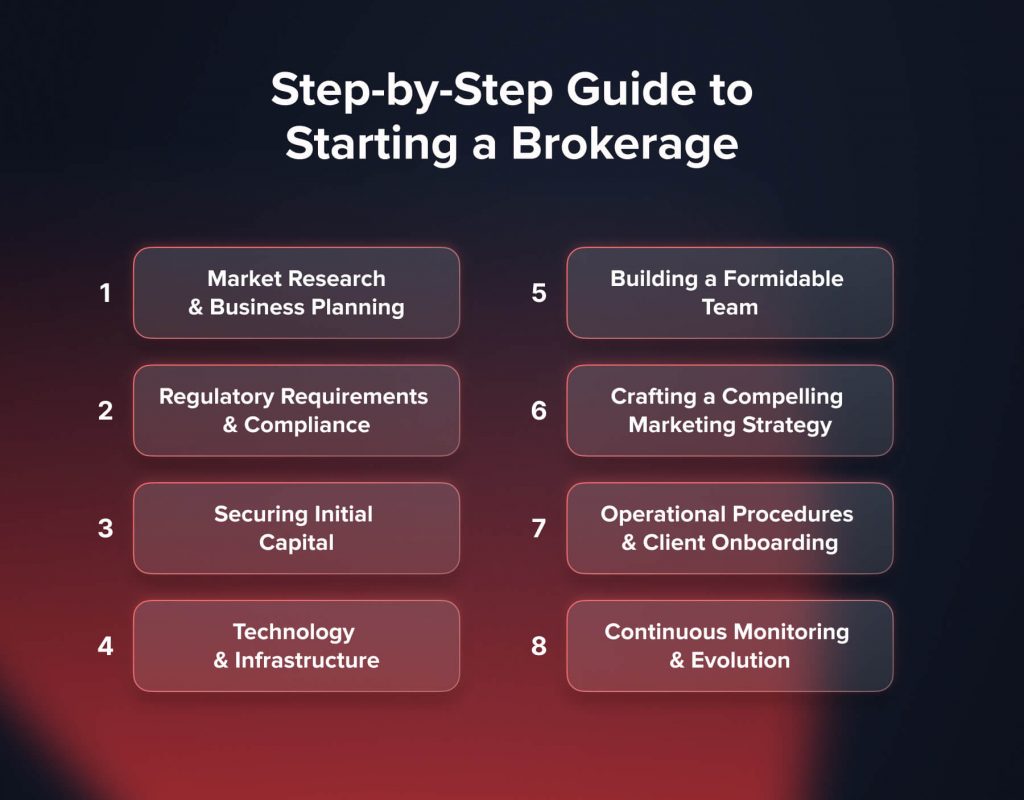

Step-by-Step Guide to Starting a Brokerage

Venturing into the brokerage business requires meticulous planning, an understanding of regulatory landscapes, and a strategic approach to market positioning. Here’s a detailed walkthrough of the journey:

1. Market Research & Business Planning

Before plunging into the brokerage realm, a thorough grasp of the market is indispensable. Begin by pinpointing a niche that resonates with your expertise and addresses a clear market demand. Given the allure of Forex and crypto, they may present enticing opportunities, but they also come with their unique set of challenges. Understand the dynamics of your chosen niche and the profile of your potential clientele.

With a niche identified, the next step is sculpting a robust business model. This is where you decide the breadth of services you’d offer. Are you leaning towards a full-service model, or do you see merit in the efficiency of a discount brokerage? Your fee structure, risk management strategies, and technology platforms are also key decisions at this stage.

A SWOT analysis can be a potent tool during this phase. By assessing your strengths, weaknesses, opportunities, and threats, you not only foresee potential hurdles but also position yourself to capitalize on market gaps.

2. Regulatory Requirements & Compliance

Every financial venture is bound by a set of regulatory frameworks, and brokerages are no exception. These regulations exist to ensure transparency, protect consumers, and maintain the integrity of the financial ecosystem.

The landscape varies across jurisdictions. In the U.S., the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) helm the regulatory reins. The U.K. sees the Financial Conduct Authority (FCA) playing this role, while in Australia, the Australian Securities and Investments Commission (ASIC) takes charge. For those eyeing the Forex space, Cyprus’s CySEC is a noteworthy entity, given its prominence in Forex broker regulations.

Delving into these regulatory bodies’ requirements is paramount. This encompasses obtaining necessary licenses, adopting rigorous Know Your Customer (KYC) procedures, and ensuring adherence to Anti-Money Laundering (AML) norms. Particularly in the realm of Forex and crypto, compliance can’t be an afterthought. It’s foundational.

3. Securing Initial Capital

Capital is the lifeblood of any business venture, and brokerages are capital-intensive by nature. The requirements can differ, with Forex and crypto brokerages often demanding substantial initial capital to cushion against market volatilities. Traditional avenues like bank loans are an option, but in the age of fintech, innovative funding solutions are emerging, from venture capital injections to crowdfunding platforms.

4. Technology & Infrastructure

In an age where trades occur in milliseconds, cutting-edge technology is not a luxury; it’s a necessity. Your technological backbone will define the trading experience for your clients, especially in high-frequency arenas like Forex and crypto. Collaborating with established technology solution providers can offer a competitive edge. Data security, given the digital nature of transactions today, is another paramount consideration.

5. Building a Formidable Team

The crux of your brokerage’s operations lies in the hands of your team. While your vision is the guiding force, the team transforms this vision into a reality. At the pinnacle are your executives, individuals whose seasoned expertise and industry connections help traverse the multifaceted financial landscape. These leaders don’t merely make decisions; they lay the foundation for the firm’s ethos and direction.

The granular analysis of market trends and financial data falls to the analysts. Their dedication to understanding market movements and crafting informed perspectives can make the difference between an ordinary and an outstanding brokerage, especially if you’re leaning towards a comprehensive service offering.

But a brokerage in the modern era isn’t just charts, trends, and financial strategies. The digital platform you offer clients is the interface of your service. This makes IT specialists the cornerstone of your operations. Their role transcends maintaining servers. They ensure every client has a seamless trading experience while simultaneously fortifying your digital assets against threats.

Of course, while technology is pivotal, the human touch remains irreplaceable. Here’s where your customer support steps in, bridging the gap between digital efficiency and human empathy. Their interactions, guidance, and problem-solving skills reflect the firm’s commitment to its clientele.

And amidst this vast machinery, someone needs to ensure that the gears turn smoothly, in sync with the legal and regulatory beat. Compliance officers wear this hat. Their unyielding focus on regulatory adherence ensures that while the firm scales heights, it always remains grounded in legal integrity.

6. Crafting a Compelling Marketing Strategy

Once your infrastructure is solidified, it’s time to illuminate your brand in the financial market’s spotlight. Your brand isn’t just a logo or a tagline; it’s a promise to your clients. The visual and tonal elements should echo trust, expertise, and innovation.

In the age of digital dominance, your online presence speaks volumes. Strategic digital campaigns, insightful blog posts, and active social media engagement aren’t just boxes to check; they’re pathways to nurture relationships with your audience.

Furthermore, knowledge is currency in the financial world. By offering educational content like seminars, webinars, and e-books, you don’t just enhance your brand’s authority but also cultivate an informed and loyal clientele base. For those interested in a more in-depth discussion on starting a brokerage, you can watch this informative webinar, which provides detailed insights and practical advice on navigating the complexities of the brokerage business. This additional resource aims to enrich your understanding and assist you in building a robust foundation for your venture.

7. Operational Procedures & Client Onboarding

Seamless operations are the silent, yet powerful, drivers behind a successful brokerage. Every trade execution, every financial strategy recommendation, and every client interaction needs to be refined to perfection. This operational finesse ensures that clients aren’t just satisfied; they’re delighted.

But before clients delve deep into financial strategies, they undergo the onboarding process. This initiation should be swift yet thorough, using digital tools to expedite processes while ensuring stringent KYC procedures are uncompromised.

8. Continuous Monitoring & Evolution

Financial landscapes are dynamic, and resting on laurels isn’t an option for a brokerage with aspirations. Stay attuned to market shifts, be it technological innovations or changing investor sentiments. Regular market surveillance, feedback loops with clients, and an unyielding focus on improvement ensure that your brokerage doesn’t just exist; it thrives.

Challenges to Anticipate

Starting a brokerage isn’t a straightforward voyage. It’s marked with complex challenges that test not only your industry expertise but also your strategic acumen. Here, we delve deeper into some of these challenges and the intricacies they bring forth:

The Dynamic Regulatory Landscape of the Forex and crypto World

Navigating the financial oceans of Forex and crypto means treading waters that are constantly in flux. Regulatory bodies across the world are perpetually evolving their frameworks to respond to market changes, technological advancements, and the global socio-economic climate. For instance, while a jurisdiction may be crypto-friendly today, policy changes influenced by market incidents or shifts in government can swiftly change that stance.

Additionally, the decentralized nature of cryptocurrencies often brings them under heightened scrutiny. Many regulatory bodies grapple with classifying them: Are they assets? Commodities? Currencies? Each classification carries its set of compliance requirements. And as a budding brokerage, keeping pace with this ever-evolving tapestry isn’t just about legality; it’s also about maintaining the trust of an informed clientele base that seeks assurance in your compliance.

The Double-Edged Sword of Technological Advancements

While technology is undoubtedly a boon, enhancing trading speeds, streamlining processes, and broadening accessibility, it doesn’t come without its pitfalls. On one hand, technologies such as AI and blockchain promise to revolutionize trading strategies and transaction transparency. On the other, they present security vulnerabilities, with cyberattacks becoming increasingly sophisticated.

Brokerages today aren’t just battling market volatilities; they’re also constantly fortifying their digital ramparts. Every technological advancement, be it a trading algorithm or a client portal, needs to be weighed against potential security threats, requiring a constant balance between innovation and protection.

Standing Out in a Crowded Marketplace

The allure of Forex and crypto has ushered in a plethora of brokerages, each vying for a slice of the lucrative financial pie. In this bustling marketplace, differentiation becomes paramount. But carving a niche is easier said than done.

It’s not just about competitive fee structures or advanced trading platforms; it’s about crafting a unique value proposition. Whether it’s a focus on sustainable investments, unmatched educational resources, or pioneering technology, finding and magnifying your unique selling point in a saturated landscape becomes a daunting yet indispensable task.

The Unpredictability of Crypto Markets

If traditional financial markets are akin to rivers with their ebbs and flows, crypto markets are more like turbulent seas. Their volatility is legendary. Factors ranging from regulatory news, technological innovations, to tweets from influential personalities can send prices soaring or plummeting within minutes.

For brokerages, this unpredictability isn’t just a trading challenge; it’s a reputational one. Guiding clients through these tumultuous waters means not just offering strategic advice but also managing expectations, ensuring risk literacy, and cultivating trust. The goal is to position oneself not as a mere transactional platform but as a guiding beacon amidst the crypto storm.

Anticipating challenges isn’t about fostering pessimism; it’s about preparation. As the adage goes, “Forewarned is forearmed.” With a keen understanding of these challenges, brokerages can strategize, adapt, and ultimately thrive, turning potential hurdles into stepping stones toward unparalleled success.

Reaping the Rewards of a Well-Strategized Brokerage Venture

Launching and operating a successful brokerage in the intricate alleys of Forex and crypto is an endeavor not for the faint-hearted. It demands meticulous planning, an unwavering commitment, and the ability to dance to the ever-evolving tunes of the financial symphony. But for those who strike the right chords, the rewards are profound, both in financial returns and the satisfaction of creating a significant imprint in the world of finance.

Every informed decision, every technological innovation incorporated, and every trust bridge built with clients culminates into a thriving brokerage venture. But this success isn’t just gauged by numbers on a profit statement. It’s reflected in the trust of clients who look to your platform for guidance, the respect of peers who acknowledge your industry contribution, and the satisfaction of a team that finds purpose in its roles. The journey to establish a brokerage is intense, but the horizon of possibilities it opens up is nothing short of exhilarating.

Conclusion

Success in the ever-evolving world of finance requires not just strategy but a commitment to continuous learning, ensuring that brokerages remain adaptable and ahead of the curve. Brokerages that foster a culture of perpetual learning, be it about market trends, technological advancements, or regulatory shifts, position themselves not just as market players, but as market leaders.

Starting a brokerage is like composing a masterpiece in the grand orchestra of finance. With the right notes of preparation, strategy, and adaptability, the music isn’t just harmonious; it’s legendary. Embarking on this journey with a clear vision, unwavering commitment, and an adaptable strategy ensures that the financial ocean’s vastness, with its challenges and opportunities, becomes a thrilling adventure, waiting to be navigated.